We joined a large tribe of teams working on the digital transformation and introduction of microservice architecture, taking ownership of several aspects of the mobile app, most notably debit and credit card management. We built a number of services, all with their own databases used for storing internal logic and none of the actual user data to ensure customer privacy.

The solution we built was implemented directly into the mobile app and deployed to well over 300,000 users, introducing greater geocontrol, 3D Secure support, and allowing users to temporarily lock/unlock their card. They could now also set ATM and POS limits, reorder expired or lost cards and view PIN. Our engineers continue to build the microservice architecture retaining the legacy platform but are progressively minimizing it as we are building a modern architecture around it.

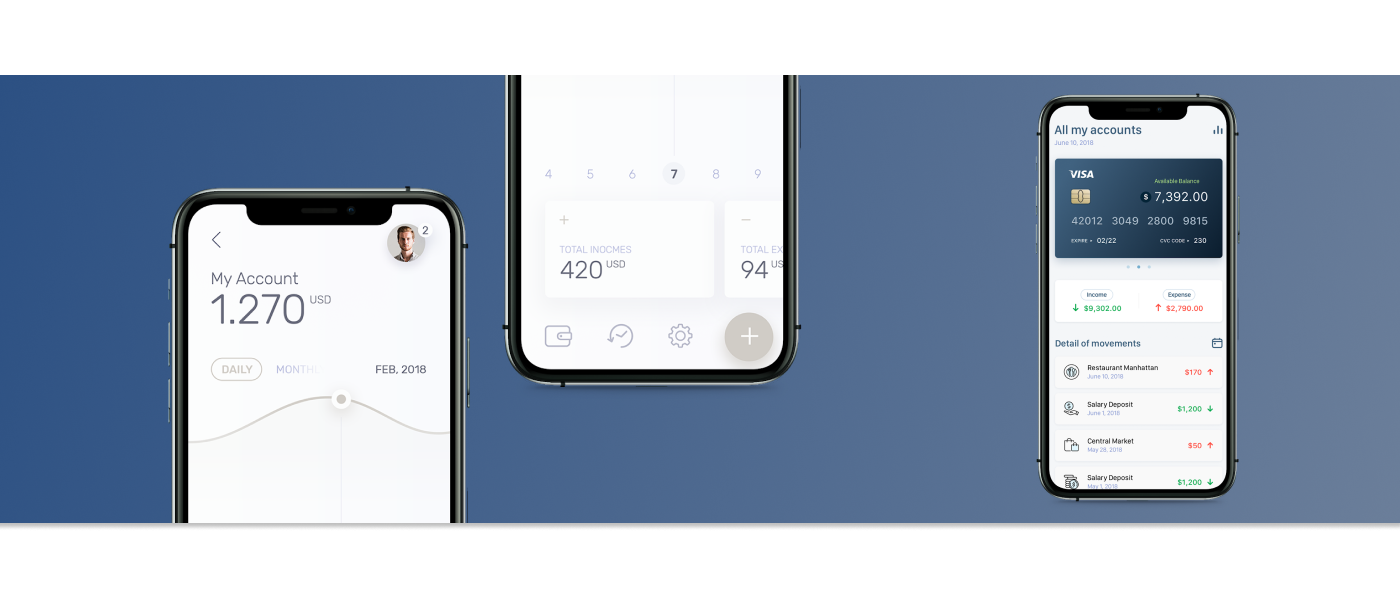

We partnered with a leading European bank to help them with the digital transformation of their core product, revamp their mobile banking portfolio, and improve customer experience. As of 2019, the bank continues to grow its revenue that far exceeds 1b€.