Article

Driving Success in the Changing Automotive Industry: Interview with Marcus Willand, Partner at MHP – A Porsche Company

The automotive industry is undergoing a rapid transformation, driven by advancements in technology and shifting consumer expectations. As traditional car manufacturers and mobility providers adapt to this changing landscape, they face a multitude of challenges and opportunities. To gain insights into this evolving industry, we sat down with Marcus Willand, Partner at MHP – A Porsche Company, a leading consulting firm specializing in digitization and mobility.

In this interview, Marcus shares his insights on MHP’s approach to providing strategic and operational competencies globally. He delves into the key success factors for German car manufacturers and mobility providers as they adapt to the changing landscape, discusses the challenges posed by companies like Tesla and Chinese EV makers, and explores technologies that have the potential to revolutionize the industry. Additionally, Marcus sheds light on the role of finances and its distribution in driving technology development, as well as the shift towards partnerships and strategic investments in the competitive global market.

Join us as we delve into the future of automotive innovation and gain valuable perspectives from Marcus Willand, Partner at MHP – A Porsche Company.

1. Could you briefly introduce yourself and provide an overview of MHP’s approach to providing strategic and operational competencies globally?

Thank you for having me! My name is Marcus Willand, and I have been working in the software and consulting industry for the past 26 years. My background is in economics, and throughout my career, I have primarily focused on two industry sectors: automotive and the public sector. From the early days, I delved into digital platforms, software as a service models, and business models for digital products. Additionally, I gained experience in lean and agile development methods during my time at SAP, where I worked for 17 years and eventually served on the board of SAP Consulting Germany, being responsible for the public sector.

About seven years ago, I noticed the increasing prominence of mobility topics in the business, investment, and software scenes. Recognizing the tremendous opportunities, I decided to explore new horizons and joined MHP.

MHP, a daughter company of Porsche, was established 27 years ago and now boasts a workforce of nearly 4,500 employees dedicated to various aspects of digitalization. During my time at MHP, I have focused on building expertise in mobility. We identified four mega trends: connected mobility, autonomous mobility, shared mobility, and electric mobility, and developed a comprehensive consulting portfolio in this area. I have led the establishment of joint ventures, authored studies, and fostered collaborations with prestigious institutions. This journey has provided me with a wealth of experience and an accelerated learning curve.

While my main focus remains on platform businesses, such as the Smart City platform ICP and mobility platforms, I have also been closely following the rise of car software. It is evident that cars of the future will function more like driving computers, requiring a transformation from traditional engineer-driven products to software-driven products. Assisting my clients in navigating this transition presents both cultural and technical challenges, but I thrive on learning and embracing such complexities. This is where my current focus lies.

2. What do you believe is the key to success for traditional car manufacturers as they adapt to the changing landscape? With companies like Tesla and Chinese EV makers leading the way, what are the main challenges they need to address?

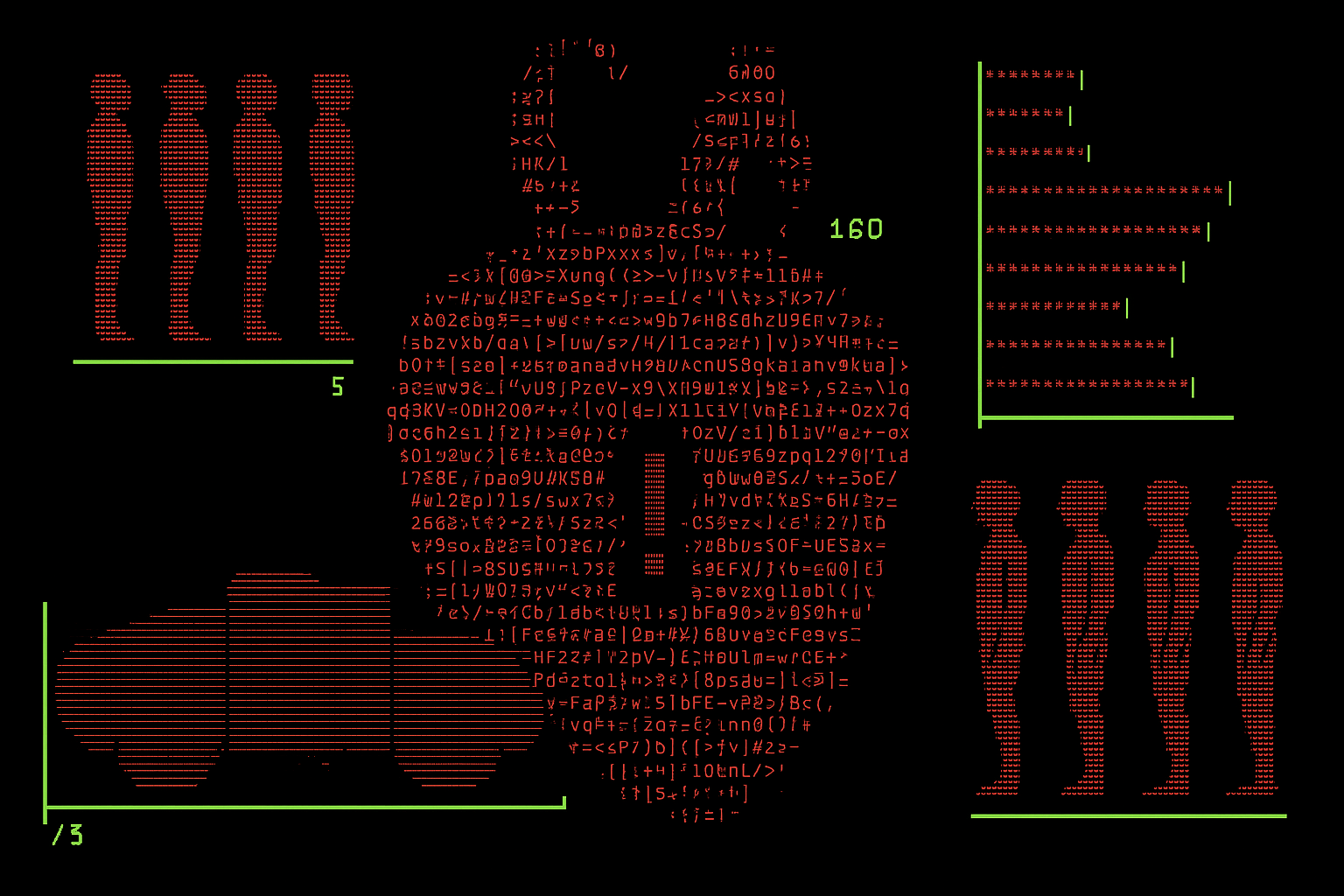

Currently, we can observe a significant shift in the automotive industry. Tesla’s unique approach to design, starting with a centralized computer as the core of the vehicle and building the car around it, has challenged the traditional paradigm. This approach, known as “first the computer, then the car,” has disrupted the industry and set a new standard. Furthermore, Chinese electric vehicle (EV) makers have embraced this approach, with some even surpassing Tesla nowadays in terms of speed and innovation. China’s EV companies began emerging about a decade ago, and their focus on digital assets was evident at the Shanghai Motor Show, where digitalization took precedence over technical specifications.

In Germany, our automotive culture has long been engineer-driven, resulting in a lengthy development cycle of seven years for a new car. This process involves numerous suppliers and a distributed supply chain, with each supplier responsible for their component. Unfortunately, this engineering-driven culture has not been conducive to software development, which requires a different approach. Unlike the traditional automotive industry, software development necessitates frequent updates and feature enrichments akin to those experienced on mobile phones. To address this challenge, we must first separate software development from car development. Releasing software updates only every seven years would not be acceptable to customers accustomed to regular updates on their mobile devices.

Currently, there are countless small software components spread across electronic control units (ECUs) in a vehicle, developed by hundreds of different suppliers. Coordinating the development, testing, maintenance, and upgrading of this fragmented software landscape poses significant organizational challenges, consumes time and resources, and increases the likelihood of errors. To mitigate these issues, we must reduce the number of software suppliers involved, ideally streamlining the process to five to ten trusted partners who can collaborate seamlessly and efficiently. This shift would enable faster iteration cycles, moving away from three and a half or seven-year development cycles to more agile weekly cycles.

Another crucial aspect of this transformation is the establishment of a central software repository. Instead of having fragmented software pieces on various ECUs, consolidating all software in a centralized repository would facilitate collaboration among partners. This centralized approach differs significantly from previous practices. While the initial idea of decoupling car development from software development was promising, the execution did not yield optimal results. As we navigate this software development-driven future, we need to explore new avenues and adapt to the changing landscape.

In summary, the key to success for traditional car manufacturers lies in embracing a new approach centered around software development. This entails separating software development from car development, reducing the number of software suppliers, and establishing a central software repository. By adopting these strategies, the industry can transition from an engineer-driven culture to a software-driven future.

3. In the realm of digital transformation in the automotive industry, are there any specific underutilized technologies that, when harnessed effectively, have the potential to revolutionize the industry?

While I wouldn’t necessarily label them as underutilized, it’s true that there is still a lot of room for further exploration and utilization of various technologies due to the ongoing demands and advancements in the field. One notable example is autonomous driving, which has made significant strides in recent years and is nearing a critical turning point. Recent developments by companies like Waymo in the US and Xpeng in China where they are introducing level four autonomous driving in urban areas, demonstrate the progress being made. The technology itself is available, but the key lies in how efficiently and swiftly we can implement it in collaboration with our partners. Achieving success in this area requires thorough preparation and execution.

What truly sets us apart, however, are two crucial factors. Firstly, car design plays an increasingly significant role, becoming just as important as technical specifications. Nowadays, the ability to develop and produce fast and safe cars has become more a convenience and the know-how is mature and widely spread. As a consequence, design has evolved into a distinguishing feature. Secondly, the infotainment system and overall user experience within the car and the brand ecosystem have become paramount. Observing how the Chinese market addresses these aspects provides valuable insights. They tend to embrace a more playful and emotional approach which resonates with the Chinese consumer base. Adapting and better understanding our target markets allows us to cater to their preferences and desires for a fulfilling interaction with their vehicles.

In essence, the car itself has transformed into a spacious and comfortable mobile device that transports individuals from point A to point B. However, the ultimate decision lies in the quality of the infotainment system and the user experience, both of which encompass the entirety of the producer’s ecosystem.

4. In terms of driving technology in a competitive global market, what are your insights on the role of money and its distribution? How do traditional OEMs cope with the challenge of investing in technology development while managing their existing business responsibilities? Can you shed some light on the shift towards partnerships and strategic investments?

The role of money in driving technology development in a competitive global market is indeed crucial. Several years ago, traditional OEMs faced challenges when venture capital-funded companies like Google’s Waymo received substantial funding for developing self-driving systems, regardless of the costs involved. In contrast, traditional OEMs had existing businesses to run, along with responsibilities towards customers and employees, limiting their available cash flow for such investments. Chinese competitors faced a similar situation, with internet billionaires venturing into the automotive industry using their vast wealth. These companies prioritized computer technology before the actual car.

However, over time, the technological landscape has evolved, making it increasingly difficult for traditional OEMs to catch up or dominate specific areas, such as autonomous driving technology. As a result, partnerships and strategic investments have become essential. It is no longer feasible for every OEM to independently develop all ADAS and Infotainment functions. Instead, the focus is on forging alliances with the best partners and assembling a product that differentiates them in the eyes of the customer.

While money remains a significant factor, the investment required is not as substantial as it was during the initial stages of technology development five or ten years ago. OEMs have made investments, and many have scaled back their costly development programs on certain aspects of technology.

5. How does MHP navigate the complex landscape of technology partnerships, and what role do you play in helping clients form strategic collaborations with key industry players?

As a consultancy, our role is pivotal in forming partnerships for our clients. We prioritize understanding our customers’ needs and ensuring we have in-depth knowledge of all relevant partners in the industry. While we maintain a neutral stance, we recognize the significance of established players like SAP, Microsoft, and AWS, who hold dominant positions in the marketplace. To meet our clients’ expectations, we have cultivated close relationships with these key partners, allowing us to provide exclusive benefits and maintain a strong track record of successful projects.

In addition to leveraging existing partnerships, we also assist our clients in developing new collaborations tailored to their specific requirements. This service is an integral part of our portfolio. Looking ahead, our focus will be on enhancing the user experience across various aspects of business, including mobility and manufacturing. We are actively involved in manufacturing operations and concentrate on cloud-based services, software, and classical system integration topics. Our goal is to ensure seamless business processes in the backend, utilizing a diverse range of players in the marketplace.

6. Considering the importance of organizational structure, technology, investments, and partnerships, what steps do you believe Germany needs to take to stay competitive in the global market? How can MHP contribute to addressing these challenges and supporting Germany’s mobility sector?

Germany needs to prioritize the serious implementation of digitalization, particularly in the manufacturing and automotive industries, in order to stay relevant. Simply undergoing digital and agile training is not enough; it requires a fundamental shift in mindset, organizational strategies, and a deliberate decoupling from existing business models. Traditional OEMs have discovered that fostering a digital mindset and establishing software production routines within engineer-driven companies is incredibly challenging, if not impossible. Therefore, a separation between digital and traditional functions is necessary, while still ensuring collaboration. This poses a significant challenge. Failure to address these issues with utmost seriousness could result in digital players gaining even more dominance and market share.

Additionally, governmental and EU regulatory frameworks must facilitate faster adaptation and response to technological advancements. By combining these efforts, there is a strong potential for Germany to enhance its competitiveness and elevate it to a higher level than its current state. MHP, as a consultancy, plays a crucial role in supporting these endeavors. We can contribute by helping organizations navigate the complexities of digital transformation, developing effective strategies, and assisting in forging partnerships that drive innovation.

Through our expertise and collaborative approach, we aim to strengthen Germany’s mobility sector and ensure its long-term success.

About Marcus Willand

Marcus Willand, Partner at MHP, helps his clients to anticipate and leverage the evolution of mobility. Focus areas are new mobility-concepts in cities, platform-based mobility-as-a-service as well as the digitalization of transport chains. Prior to that Mr. Willand held responsibility for automotive clients, later on in SAP Consulting’s managing board for the entire public sector in Germany. Doing that he helped his clients digitalizing their companies and developing new business models.

About Author

Elena Dimoska is a communications & marketing enthusiast with great passion to communicate value in a way that reinforces business success beyond revenue growth.

One of her missions as part of TrueNode is to internalize the topic of innovation and digital transformation in large enterprises and to help more well-known brands leverage innovation to make impact. For that purpose, Elena is interviewing innovators from well-established brands across Germany and Europe.