Article

Established Insurers Under Pressure – How Attackers are Pushing for a Seat at the Table

A New Situation

Many industries have been blessed with increasing revenue and growth during what was the longest economic expansion in recent history. A recession, as many analysts agreed, was only a matter of time and it hit the world very abruptly at the beginning of 2020 from a direction no one predicted.

The COVID-19 pandemic swept across the globe at a time when the global insurance industry was already showing signs of slowing growth rates. As economic conditions became increasingly volatile and markets matured insurers are now having a hard time maintaining their profitability.

Still, the industry is very much alive. Shaken by the disruption undergoing in the finance industry insurers have realized that they have been too comfortable for too long and are starting to take corrective measures. Insurers are reinventing their products, operations, and business models to cover evolving exposures, trying to satisfy rising customer expectations, all while integrating new technologies set to shake the very foundations of the industry.

But as COVID-19 has acted as a catalyst for major change, driving digitization and drastically changing consumer behavior and expectations the question arises whether current efforts are enough to survive in these rapidly changing market conditions. Instead, now seems to be the time of InsurTechs and tech giants like Google, Apple, and Alibaba.

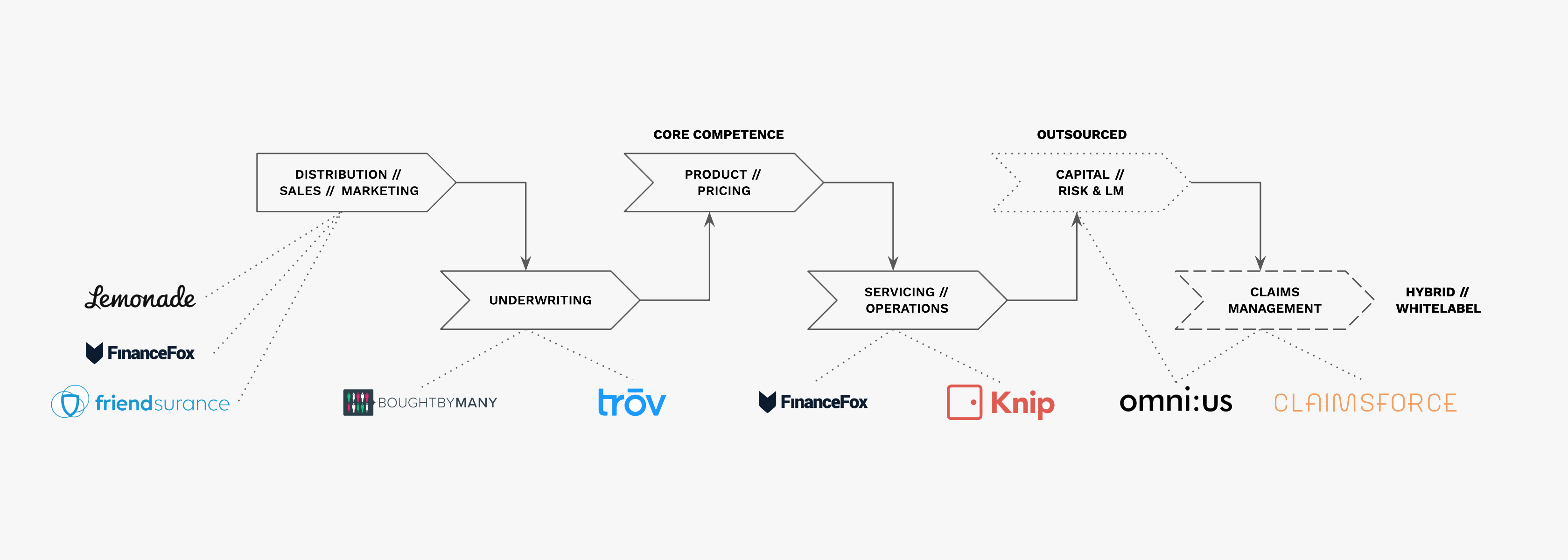

Many startups in the insurance industry were – and still are – well funded and have made a name for themselves by now. While it doesn’t seem that the insurance industry will be disrupted like other industries, these InsurTechs have cherry-picked certain elements along the value chain and with a lot of dedication, focus and technological innovation managed to gain a seat at the table.

Digital Attackers Reinvent Customer Dedication

Insurers have built exceptional IT applications over the last decades. The complexity of their products and operations has rigorously been transferred to the underlying systems, which is an accomplishment on its own. But nowadays big tech and tech-savvy startups have one major advantage over their traditional counterparts: They know that it is important to “move fast and break things” (to quote the infamous Facebook motto) and they have the ability to do so.

Technological innovations exponentially increased over the last years and mainframe technologies and software languages like COBOL became rather outdated. With their services exclusively born in the cloud and implementing the newest software development standards and best practices, InsurTechs and digital insurers have the ability to beat an incumbent insurer in almost any speed-related metric, be it claims handling, customer onboarding or more generally in the entire software development life cycle.

As customer-centricity will play a vital role in future success, traditional insurers should be alarmed by their performance. All of these metrics can be directly mapped to customer satisfaction and therefore retention. In addition, by improving their claims handling processes and time-to-market, digital attackers profit from reduced costs, leading to higher margins.

But it’s not only these aspects that play a vital role in digital attackers’ ability to give incumbents a hard time. Digital attackers have a better understanding of what the customers want and how to deliver on these needs, as they have focussed on the customer-facing end of the value chain. They are capturing vital data points to further improve their offerings on a continuous basis. On top of that, they cultivated an ownership mindset that enables agile teams to take full responsibility for their products and make fast decisions.

In fact, the ability of attackers to make swift and decisive moves has led to the value chain becoming more and more fractured, leaving the incumbent insurers with less control over their former domains. Instead, this will lead to an increasing amount of strategic partnerships between incumbent insurers and InsurTechs.

As the insurance industry has approached this strategic inflection point, incumbent insurers really must ask themselves what they can do to stay ahead of the curve. Otherwise, they might see all the leverage at the negotiation table shift over to their digital attackers.

Adapt to Change and Redefine Core Competencies

Insurers may not become a technology leader like Apple or Amazon. Nevertheless, it might be a good time to reflect on how to redefine a business that has long been shaped by an undisputed leadership of business and IT.

Instead of wanting to regain full control over the value chain, insurers should take a close look at which business functions could be sourced out, purchased, or developed inhouse. Therefore, it is mandatory to establish an experimentation mindset within their organization, to include the customer every step along the product development way and to set up the internal structures to do so.

Only by having the courage to experiment, fail, and launch constantly, insurers will reclaim their competitive advantage. Only by putting product-obsession at the heart of business insurers can really innovate. And only if they manage to transform their technological foundation, incumbent insurers will lead the market and get to dictate the terms of potential partnerships with their InsurTech counterparts or if tech giants like Google, Apple, or Amazon decide to enter the market.

If you want to learn more about how TrueNode helped clients in the insurance industry to tackle these challenges and create great value for their customers, head over to our Case Study section.